Want to park your money in a moderate-yield interest account that has a conscience? Then maybe Aspiration Bank is the place for you.

RELATED: This new 13-month CD pays a guaranteed 2.35% — with no fees for early withdrawal

Aspiration Bank: The bank with a conscience

What does the word “bank” mean to you? Is it just a place to deposit your money — maybe one that you hardly ever visit because you do mobile banking? Or do you want a more meaningful relationship with your bank, even if all your interactions are digital?

If you fall into the latter category, you may want to check out Aspiration Bank.

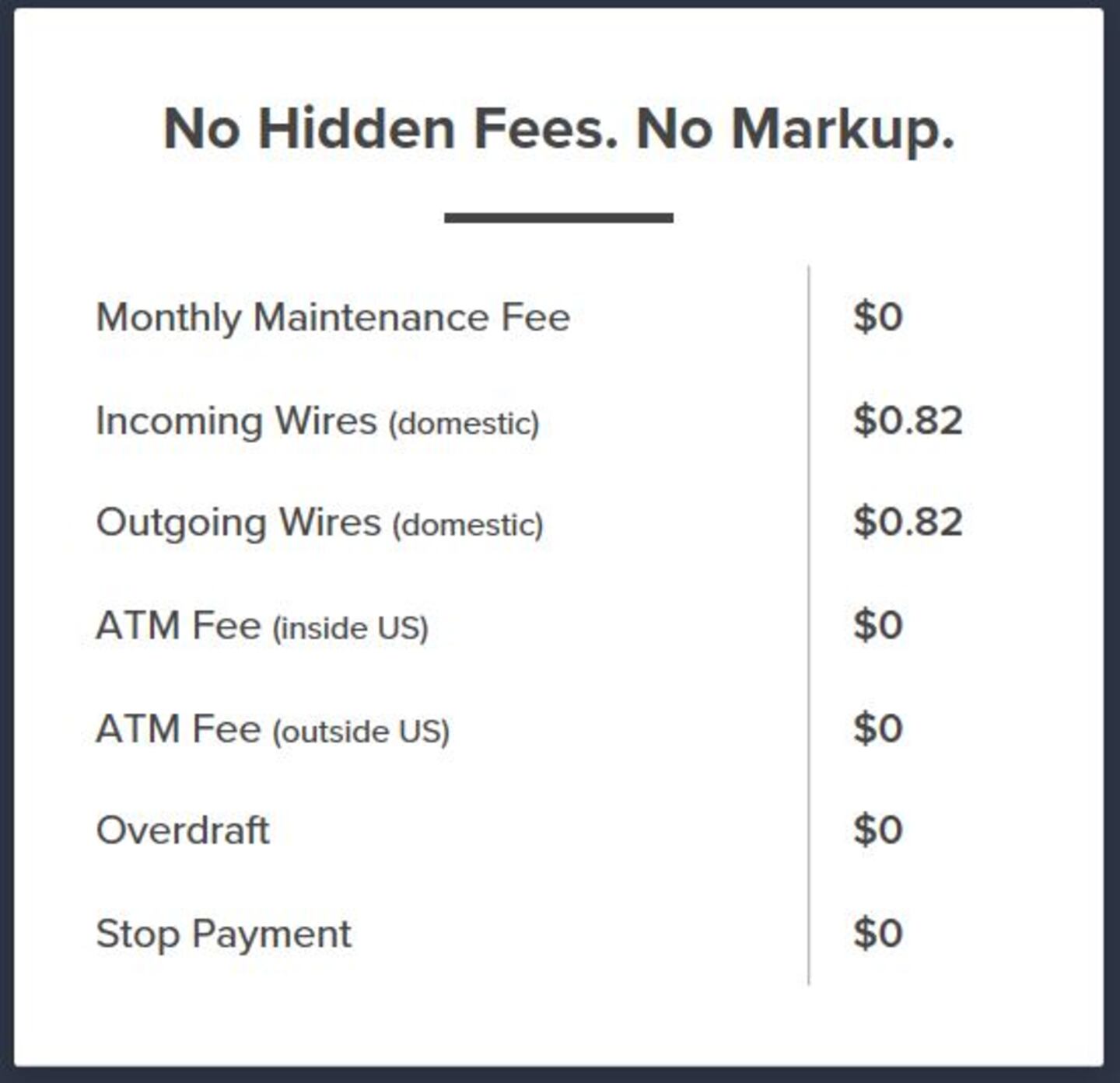

This financial startup is differentiating itself from the pack with a focus on no hidden fees and by making charitable giving a cornerstone of its business model.

Here’s what you need to know before opening an account…

You’ll pay zero ATM fees around the world

The average fee across the banking industry for using an out-of-network ATM is $4.68, according to BankRate.com.

But with Aspiration Bank's FDIC-insured Summit Account, that fee is a big, fat goose egg: Zero. And that applies to both domestic and foreign ATMs.

Furthermore, there’s no monthly minimum balance required and no hidden fees of any other kind.

You’ll earn 1% annual interest on your entire balance

Aspiration isn’t exactly a high-yield account, but its 1% APY on your money is nothing to sneeze at, either.

That's about 100 times more interest than you'd earn on your money in simple savings at most of the nation's big banks.

However, some other online banks will give you double that interest — easily in the 2% APY range. We've got a list of them here.

10% of Aspiration’s earnings go to charity

Why would anyone want to earn 1% when you could be earning 2%?

This may be one reason why: Aspiration Bank donates 10% of its earnings to a variety of charities that it says are all vetted for being financially responsible with donations.

Aspiration says its primary giving partner is Accion, America's largest nonprofit provider of microloans to low-income entrepreneurs looking to lift themselves out of poverty by starting a business.

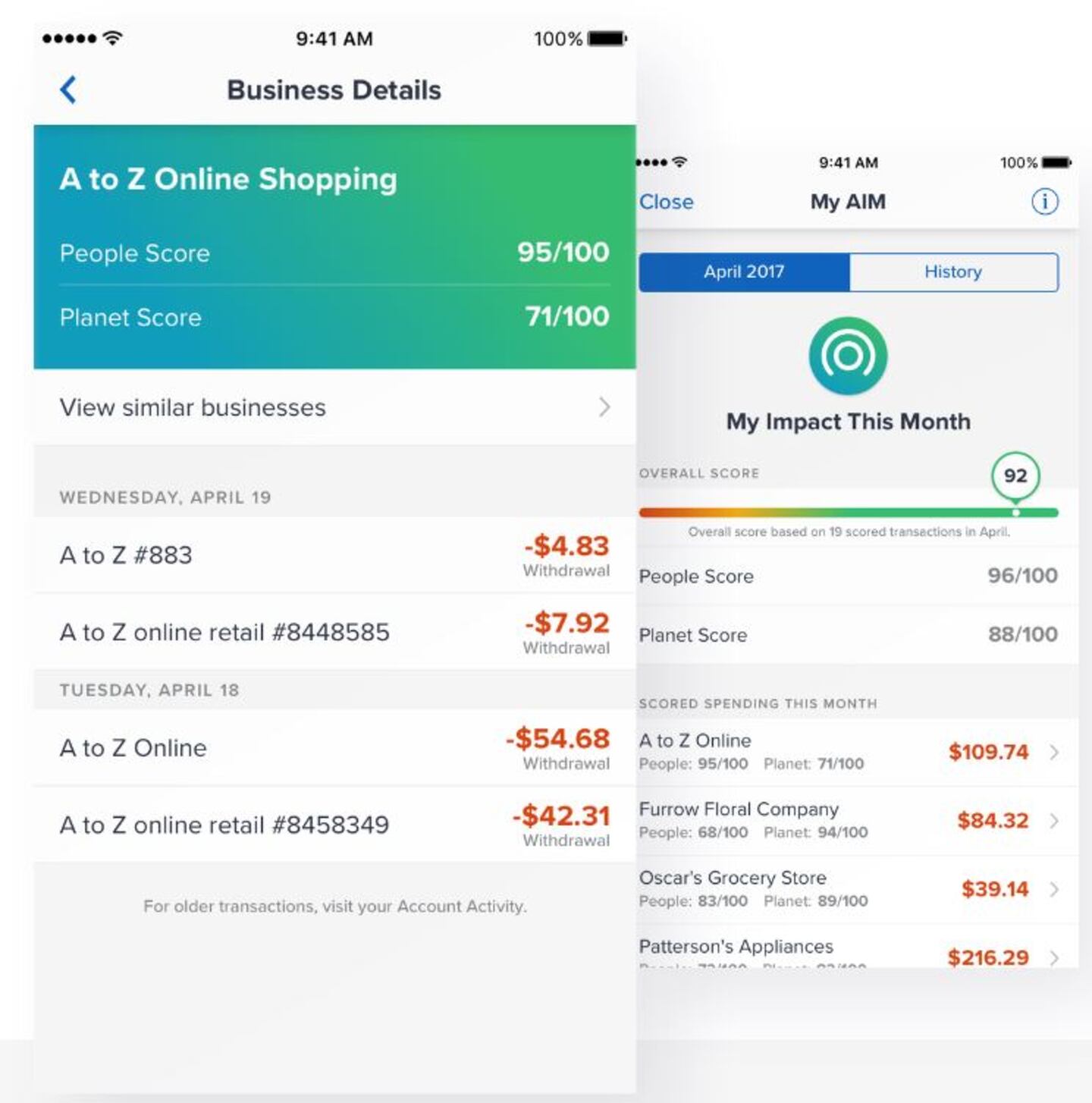

The Aspiration app helps you align your spending with your values

Built right into the Aspiration app is a proprietary Aspiration Impact Measurement (AIM). Your AIM score is a measure of how responsibly you’re directing your dollars as a consumer when you do your everyday spending.

The measurement works by Aspiration grading businesses on how well they treat their employees and the environment. Then based on your spending at those businesses, the app can crunch an impact score for you on a 100-point scale.

It’s a unique way to highlight how the notion of getting value as a consumer intersects with your personal values as a human being.

You get $1,000 in free identity fraud expense reimbursement

ID theft expense reimbursement* is offered as a free service when you open an account. Should you suffer financial loss as a result of identity theft, you'll be compensated with up to $1,000 per claim.

While that’s a nice offer, money expert Clark Howard has a better suggestion for you: Put a freeze on your credit files.

While not entirely foolproof, credit freeze remains the #1 way to shut down the ability of criminals to impersonate you and open new lines of credit in your name.

We've got complete instruction to guide you through the credit freeze process here.

* Identity Fraud Expense Reimbursement is not available to residents of the state of New York.

Free cell phone protection insurance is available

Aspiration Bank also offers something that so far has only been made available as a freebie by a small handful of other banks: It will pay to replace your stolen or damaged cell phone.

In order to qualify for this free coverage, you must pay your monthly cell phone bill through Aspiration's debit card.

Coverage is limited to damage or theft up to $600 per claim subject to the terms, conditions, exclusions and limits of liability of this benefit — though you do have to pay a $50 deductible before coverage kicks in.

Read more about the policy exclusions here.

Interested in opening an account?

The minimum deposit you'll need to open an Aspiration Account is $10. Get started with the simple application process here.

Once you're signed up, you're encouraged to invite friends and family to sign up, too. For every person who joins you, Aspiration will donate a total of $50 — $25 for you and $25 for your friend — to the charitable cause of your and their choice.

More banking stories on Clark.com

- New breed of card skimmers at gas stations pose high-tech threats

- Lots of banks are offering free cash: Should you bite?

- Here's the #1 mistake we're making with the money we're saving

The post Aspiration Bank: 7 things you need to know before you open an account appeared first on Clark Howard.

Clark.com