JACKSONVILLE. Fla. — Action News Jax investigates your rights when you pay for car rental insurance.

“Do you feel like you have been steered wrong?” Action News Jax Ben Becker asked Shonnie Thompson. Thompson said, “Yes I do.”

STORY: Babysitter charged with murder after violently shaken baby dies of injuries 35 years later

Thompson sent Becker an email saying, “I think I’m being overcharged for repairs to a rental car.”

”We are looking at $2,400, that’s a lot of money,” said Becker. “Right, that’s for an oil pan,” responded Thompson, who sent Becker a picture of a leaking oil pan from the 2020 Ford Eco-Sport she rented from Hertz which was damaged when Thompson says she ran over road debris.

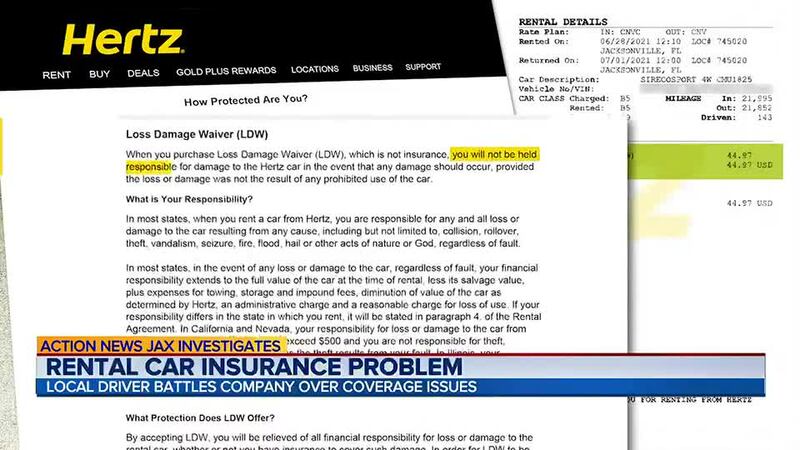

According to an estimate, Hertz not only billed Thompson $1988.44 for the damage, but also $150 for administrative fees and $272.04 for diminished value, bringing the total to $2,410.48.

Becker went through the rental agreement and found Thompson purchased a limited damage waiver and collision damage waiver.

Hertz says with the limited damage waiver “you will not be held responsible for damage to the Hertz car in the event that any damage should occur, provided the loss or damage was not the result of any prohibited use of the car.”

But later in the agreement, it somehow showed Thompson declined the limited damage waiver and instead only had a partial damage waiver, meaning she is responsible for anything over $1,000.

READ: ‘Young and stupid’: South Dakota woman convicted of leaving baby to freeze in ditch in 1981

“This is an unusual situation,” says Action News Jax law and safety expert Dale Carson.

Becker sent Carson the rental agreement and asked him about the discrepancy in coverage that Thompson says she had nothing to do with.

“She can bring an action in arbitration against Hertz for forcing her to pay for the damage to the car that she bought extra insurance to cover,” said Carson. But instead Thompson asked Becker to take action, who emailed Hertz about Thompson’s situation. Hertz provided this statement:

“Although we rely on the signed rental agreement for a clarification on charges, as a one-time gesture of goodwill, we have waived the claim due to the inconsistencies between the documents.”

Thompson and Becker met again a few weeks later and Thompson gave Becker a card for resolving her Hertz headache. “Ben you get the job done,” said a joyful Thompson.

“You can’t see behind here,” Becker pointed to his mask. “But I’m going to blush.”

Experts say think twice about purchasing car rental insurance. Typically your own insurance will suffice if you have collision and comprehensive coverage although you will have to pay a deductible and your rates will likely go up if you use it.

In addition, some credit cards offer rental insurance benefits. However, primary coverage is typically a perk only on premium cards that charge an annual fee.

©2021 Cox Media Group