JACKSONVILLE, Fla. — From beaches to big cities, it’s no surprise Florida is one of the country’s top travel spots. Hundreds of northeast Florida homeowners are taking advantage of the summertime beach living to put rooms up for vacation rentals, but are finding a hidden cost in renting out their place.

For people like David Bradfield, living in and renting out parts of his 3-story St. Augustine Beach house, it’s getting out of hand.

>>> STREAM ACTION NEWS JAX LIVE <<<

“I now pay close to $300,000 here, on my homestead,” Bradfield said.

He’s been renting out rooms in his house for years as a way to make extra money. But since starting the vacation rentals, his property taxes have gone up more than $1,817. Looking through his property records, his property value has shot up by more than $333,000 in the last decade.

“I live more in my home than any single person possibly could, and I feel like I’m being punished for it,” Bradfield said.

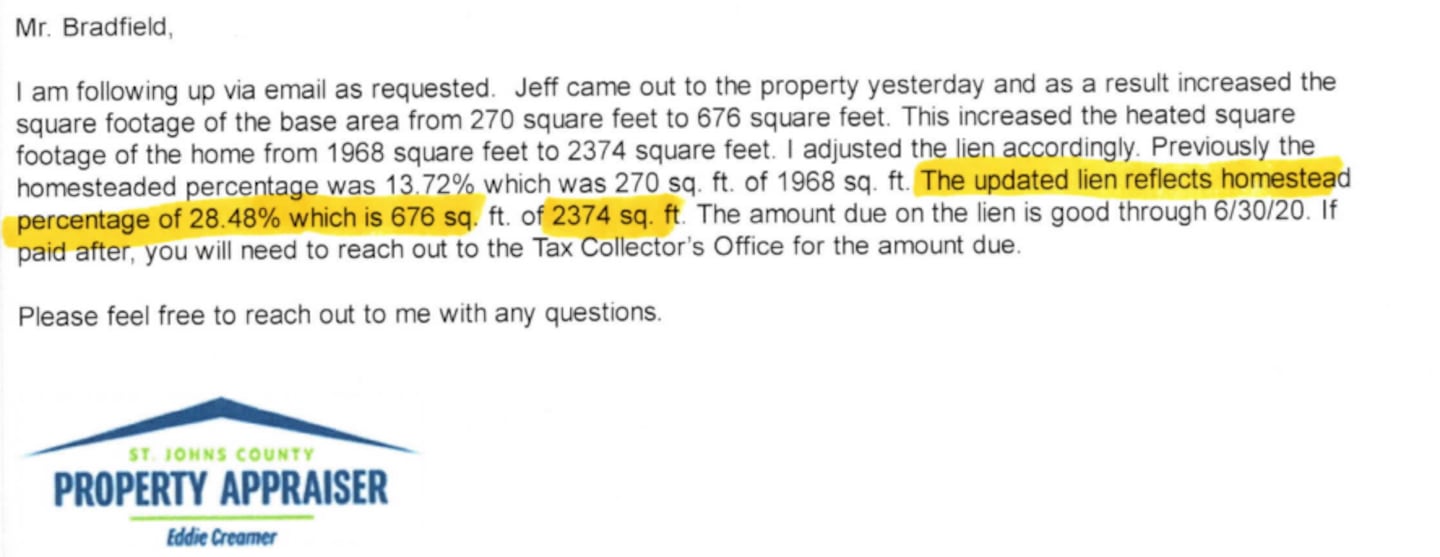

Bradfield said he rents out rooms in his home sometimes as often as 180 days out of the year, usually no more than a couple days to around a week at a time. When he rents out rooms, it’s usually the top two floors of his house, during which he stays in an apartment he’s made for himself in his garage. But because he’s renting out the top two floors as often as he is, the garage apartment is now the only part of his property where he still has a homestead tax exemption.

In the eyes of the county, it means Bradfield, technically, doesn’t even live in the main part of his house.

“The fact that anyone would accuse me of not living in this home at any point in the last 24 years, with no proof, whatsoever, is simply ridiculous,” Bradfield said.

Florida law allows property tax exemptions after owning your home for a year. Part of it includes a “homestead tax exemption,” which takes $50,000 off the taxable value of your home. The state also has what’s called a “Save Our Homes” protection for homeowners, which puts a 3% cap on how much your home’s taxable value can go up each year. The state says it’s a means of keeping people from being priced out of their homes, over time.

But Florida law also says renting “all or substantially all” of your home can cause you to lose those tax exemptions if it’s rented for 30 total days each year for two years in a row.

INVESTIGATES: Chief of affordable housing answers tough questions about Jax 2019 property giveaway

Action News Jax’s Finn Carlin reached out to the Florida Department of Revenue about what this means for homeowners, like Bradfield, who only rent out a few rooms, not the whole home, while living in it:

Finn Carlin: Do property appraisers in Florida have the power to partially remove the homestead exemptions for homeowners, particularly people who permanently stay in the home, only renting out part of their home for temporary vacation rentals?

FL Dept. of Revenue: Yes. Both the Florida Legislature and the Florida courts have for many years indicated the legal requirement for homesteads to be used as such and not for commercial purposes. Section 196.031(4), Florida Statutes, states “the exemption provided in this section applies only to those parcels classified and assessed as owner-occupied residential property or only to the portion of property so classified and assessed.”

Property tax troubles for homeowners renting our rooms is an issue recently taken up in Florida’s courts. Last year, the Florida Supreme Court ruled in favor of the Sarasota County Property Appraiser, Bill Furst, who had taken off some of the tax exemptions for a homeowner, Rod Rebholz, who was renting out rooms in his home.

INVESTIGATES: Take 5 blamed for ‘substandard work’ on JSO cruisers; damaging vehicles across country

It overturned a district court decision in Rebholz’s favor, which said property appraisers in the state can’t “carve up” someone’s house to take away parts of their tax exemptions. It’s something we also brought up to the Department of Revenue:

Finn Carlin: Last year, the Florida Supreme Court ruled in Furst v. Rebholz that the previous district court ruling was ‘quashed’ by the high court. Does the ruling overrule all of the language within it?

FL Dept. of Revenue: When the Florida Supreme Court does this to a lower court decision, it means the lower court decision can no longer be relied upon or cited for any legal principles that it suggests.

It’s worth pointing out that, in the Furst v. Rebholz case, the homeowner was renting out rooms for several months in a row, as opposed to renting out parts of his home every now and then, like a typical vacation rental might. The homeowner had also, essentially, given full use of the rooms he was renting out to the people staying there, rather than allowing someone to stay in their part of the home for a short time. The Department of Revenue says none of this changes the power of property appraisers to remove parts of someone’s tax exemption.

We got numbers of all the homes in northeast Florida’s beach counties with parts of their homestead exemptions gone:

- Duval County: 5,378 properties have partial homestead removal

- St. Johns County: 408 properties have partial homestead removal

- Nassau County: less than 20 properties have partial homestead removal

[DOWNLOAD: Free Action News Jax app for alerts as news breaks]

St. Johns County property appraiser Eddie Creamer gave us a statement about the local homes losing out on the tax cuts:

“If you’re renting out a portion of your property or all of your property, you are not occupying that part. So we remove that portion of the property from the homestead exemption.”

Duval County property appraiser Joyce Morgan said she runs things the same way in Jacksonville.

“If you’re living in the home at the time you’re renting it out or if you’re renting part of it out, you do lose that part of your homestead,” Morgan said. “You can’t have the whole thing as a homestead if you’re not using it all as a homestead.”

[SIGN UP: Action News Jax Daily Headlines Newsletter]

But Bradfield said living in his home while renting it out is the exact reason he shouldn’t have higher taxes.

“You can’t say I’ve abandoned my home if I’ve never left it. Period,” Bradfield said.

Northeast Florida’s property appraisers say anyone who has issues with their property tax statements should take it up either through their offices or your county’s value adjustment board, which typically settles these kinds of cases.

Click here to download the free Action News Jax news and weather apps, click here to download the Action News Jax Now app for your smart TV and click here to stream Action News Jax live.